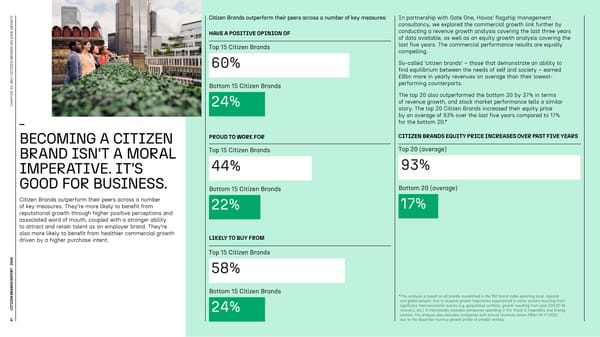

Citizen Brands outperform their peers across a number of key measures: In partnership with Gate One, Havas’ flagship management consultancy, we explored the commercial growth link further by HAVE A POSITIVE OPINION OF conducting a revenue growth analysis covering the last three years of data available, as well as an equity growth analysis covering the Top 15 Citizen Brands last five years. The commercial performance results are equally compelling. 60% So-called ‘citizen brands’ – those that demonstrate an ability to find equilibrium between the needs of self and society – earned £8bn more in yearly revenues on average than their lowest- Bottom 15 Citizen Brands performing counterparts. The top 20 also outperformed the bottom 20 by 37% in terms CHAPTER 03: WHY CITIZEN BRANDS DELIVER GROWTH 24% of revenue growth, and stock market performance tells a similar story. The top 20 Citizen Brands increased their equity price by an average of 93% over the last five years compared to 17% for the bottom 20.* BECOMING A CITIZEN PROUD TO WORK FOR CITIZEN BRANDS EQUITY PRICE INCREASES OVER PAST FIVE YEARS BRAND ISN’T A MORAL Top 15 Citizen Brands Top 20 (average) IMPERATIVE. IT’S 44% 93% GOOD FOR BUSINESS. Bottom 15 Citizen Brands Bottom 20 (average) Citizen Brands outperform their peers across a number of key measures. They’re more likely to benefit from 22% 17% reputational growth through higher positive perceptions and associated word of mouth, coupled with a stronger ability to attract and retain talent as an employer brand. They’re also more likely to benefit from healthier commercial growth LIKELY TO BUY FROM driven by a higher purchase intent. Top 15 Citizen Brands 4 202 58% Bottom 15 Citizen Brands * This analysis is based on all brands researched in the 150 brand index spanning local, regional and global players. Due to atypical growth trajectories experienced in some sectors resulting from CITIZEN BRANDS REPORT significant macroeconomic events (e.g. geopolitical conflicts, growth resulting from post-COVID-19 24% recovery, etc.), it intentionally excludes companies operating in the Travel & hospitality and Energy sectors. The analysis also excludes companies with annual revenues below £10bn for FY2022, 21 due to the dissimilar revenue growth profile of smaller entities.

Citizen brands Page 20 Page 22

Citizen brands Page 20 Page 22